HMRC: User-centred design of VAT refund scheme for non-EU tourists.

Working within the HMRC policy team to explore the digitisation of VAT refunds using a design research & service design approach.

Brief

How can the government digitise VAT Refunds in a way that works for both tourists & businesses, whilst reducing abuse & protecting tax revenue?

Approach

In depth research with retailers, airports, Border Force & the VAT refund providers to understand the end-to-end process + core pain-points. A survey with 100s of UK tourists from 3 major non-EU countries. Service design workshops with HMRC & the retail industry to define a vision for a digital solution.

Outcome

A blueprint for a digital VAT RES solution along with an animated video illustrating the key benefits. A set of detailed personas for all key players in the space. A tool for estimating government time & resource savings for various digital options.

Contextual research

50+ hours of observation at key UK airports, retail zones & luxury shopping stores to understand the end-to-end process of purchasing eligible items, obtaining the VAT RES paperwork & making a claim at the port of depature. This included several days spent with Border Force to document the process + understand operational enforcement challenges.

Outcome: Creation of current state process flows, service blueprints & risk maps. Data collected at airports allowed incidence rate of various issues & inefficiencies to be calculated for the very first time.

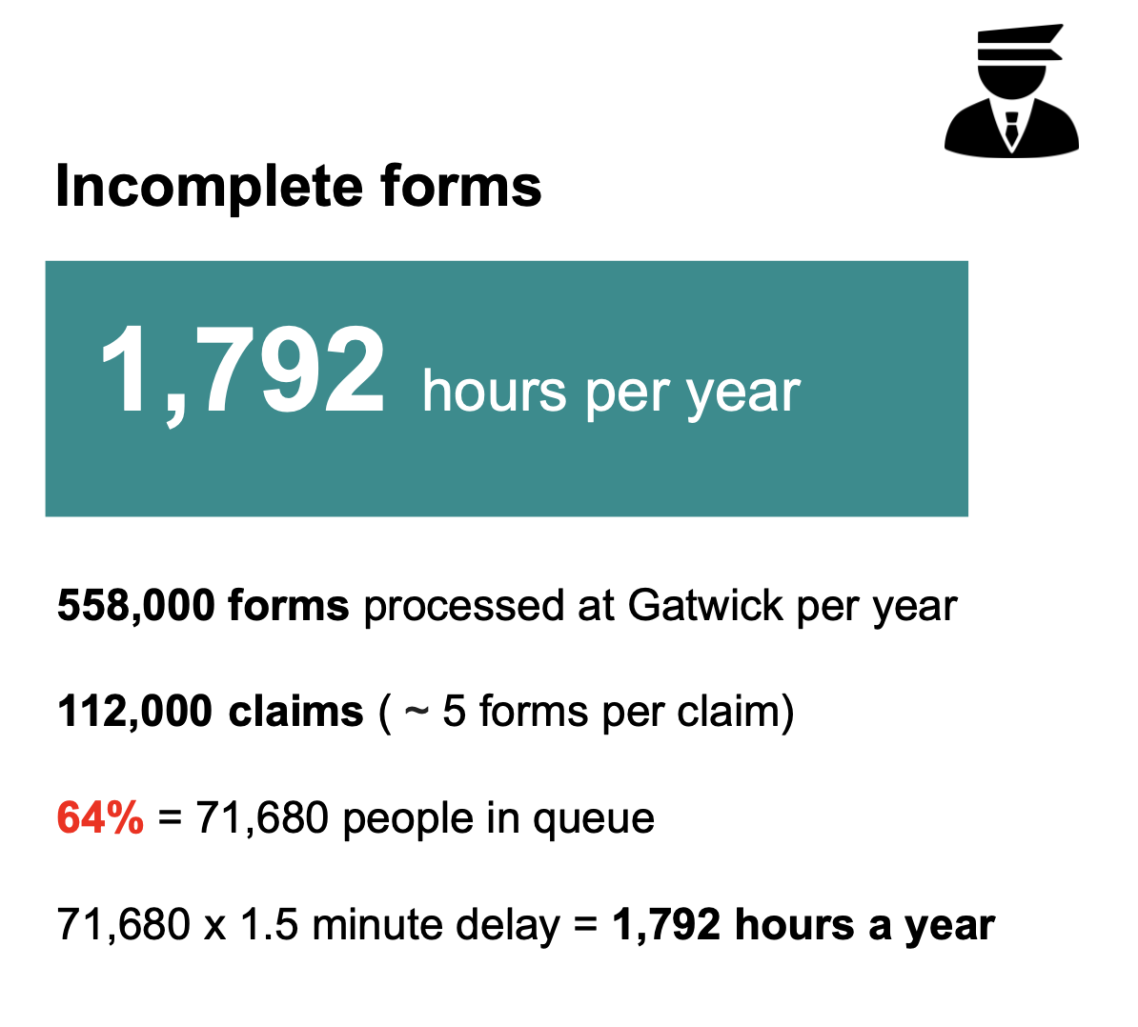

Inefficiency calculations

Data collected in the field on inefficiencies of the paper based system & the observed incidence of various issues enabled calculations on workflow inefficiencies & conversely cost savings from digitisation.

Outcome: The ability to quantify specific design decisions for the digital system in terms of cost savings.

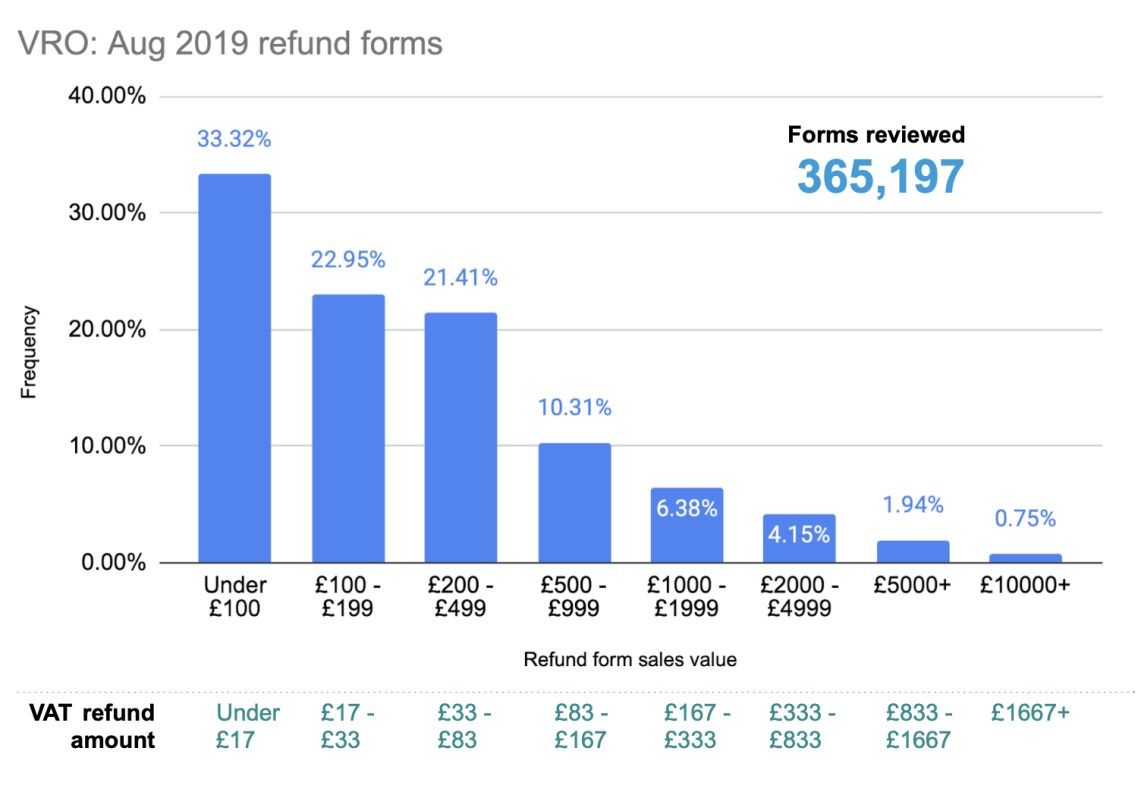

Quant data analysis

User research activities were supplemented with quant data analysis to understand the volumes of paper forms of different types.

Outcome: A big picture view of the scale of various scenarios, allowing objectie decison making on design & feature prioritisation.

Competitor review & evaluation

A range of app based & digital kiosk based solutions from around the world were reviewed. Each process was mapped out and relative strengths & weaknesses documented.

Outcome: Ready made components and patterns to feed into the new UK digital solution Blueprint & service design work.

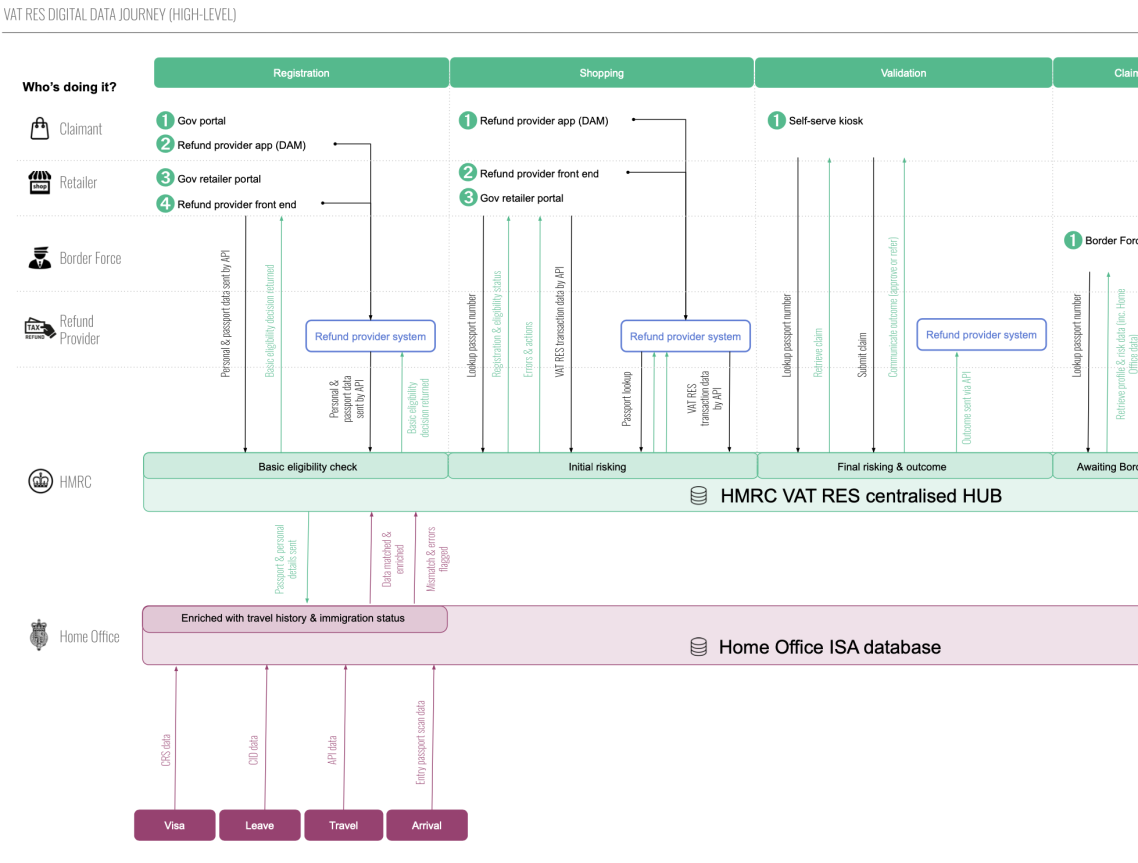

Data flow analysis & mapping

The backbone of the VAT RES system is the transaction + user data that flows from retail POS, through third party VAT refund providers to HMRC. This flow was mapped out.

Outcome: An understanding of what data flows through the system, where it's captured and how it travels downstream.

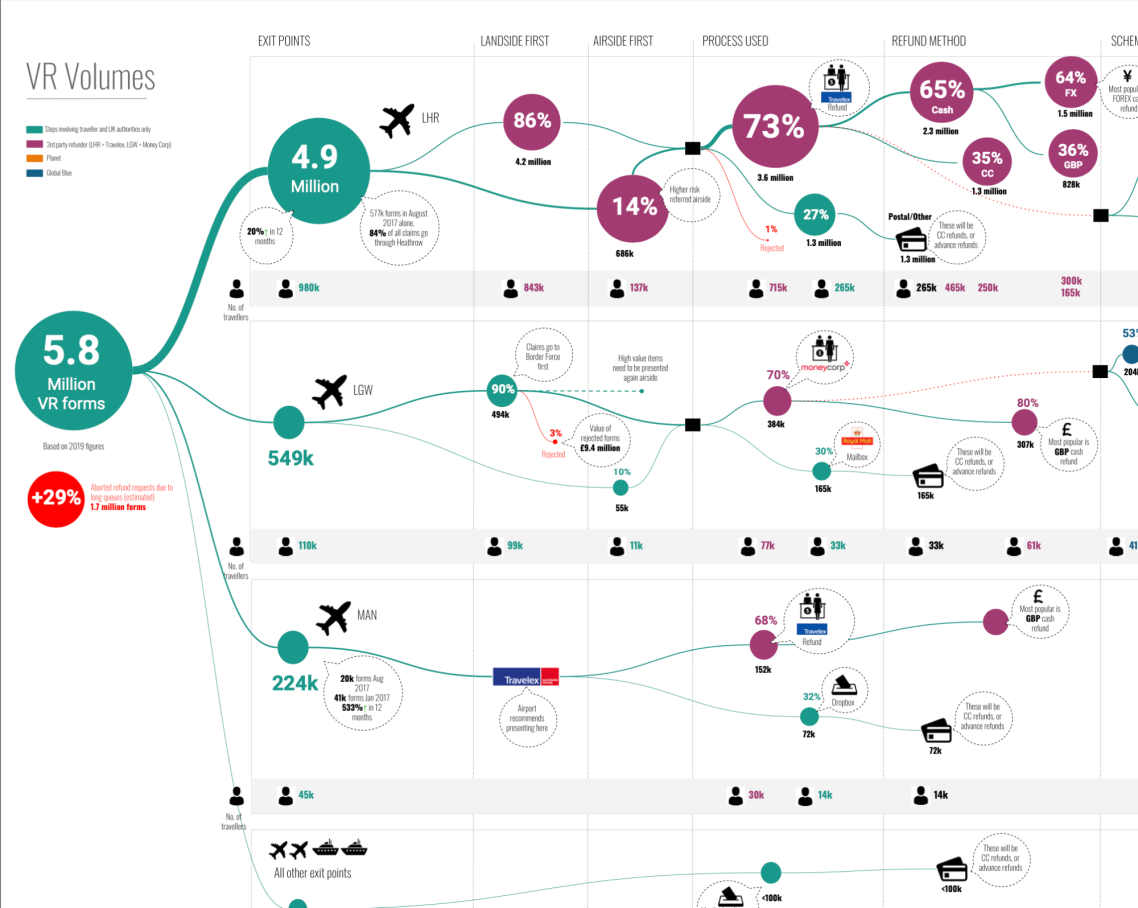

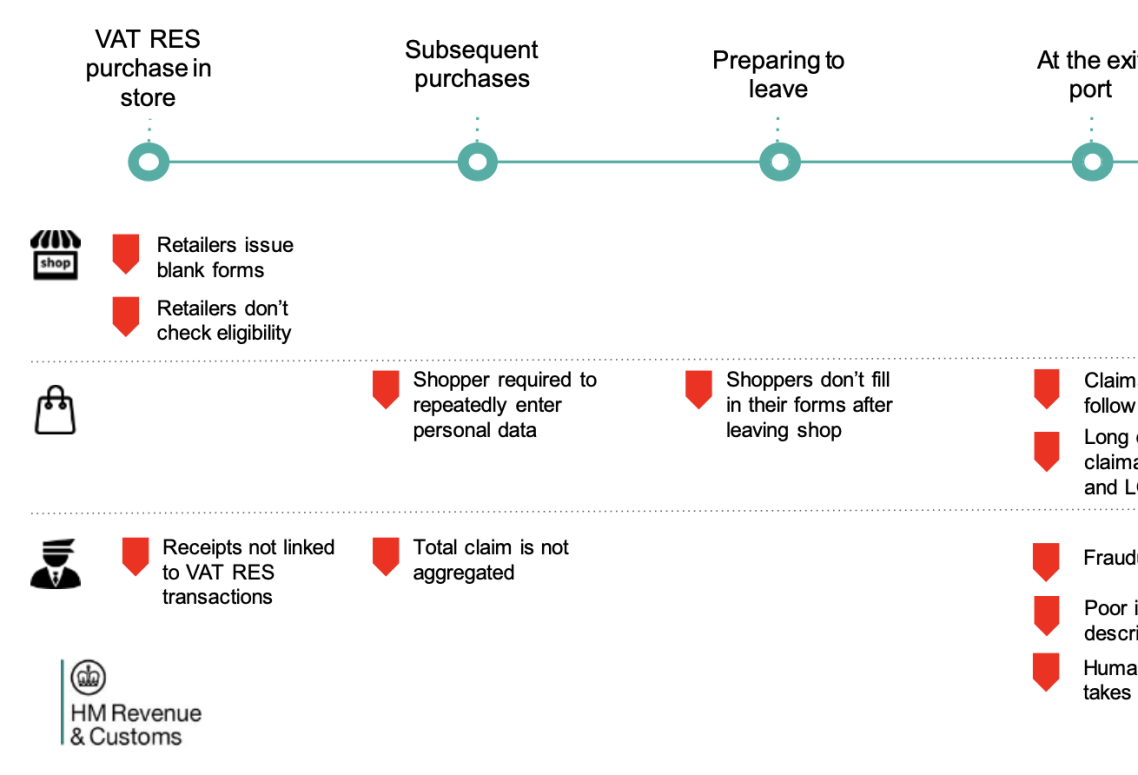

High-level service visualisations

Various visualisations & posters were produced to show key parts of the process & the associated quant data & pain-points at an overview level.

Outcome: Artefacts that facilitated prioritisation of research & design trade-offs within the proposed solution.

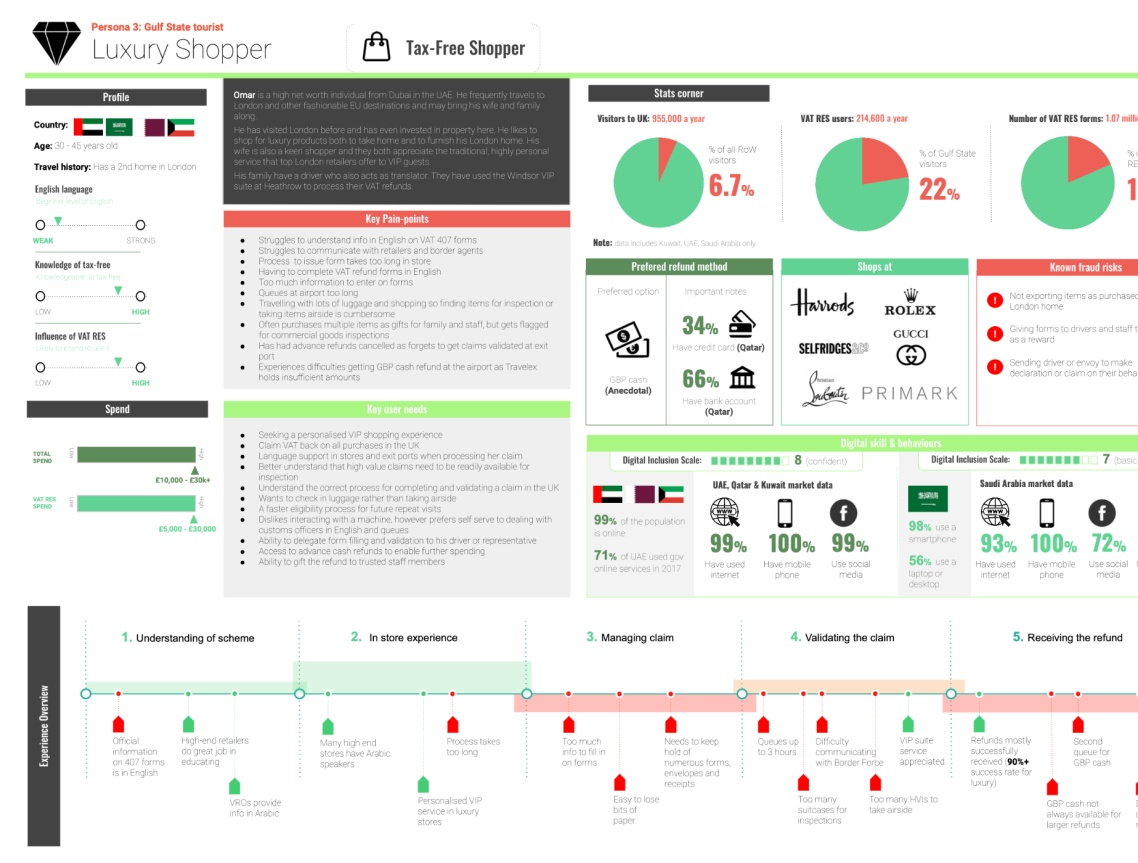

In depth personas

Personas to summarise the needs, challenges & behaviours of all key actors in the system. These included both qual insights from user research & quantative data from industry.

Outcome: A clear understanding of the most critical needs of each group within the system, from retailers to tourists to government bodies.

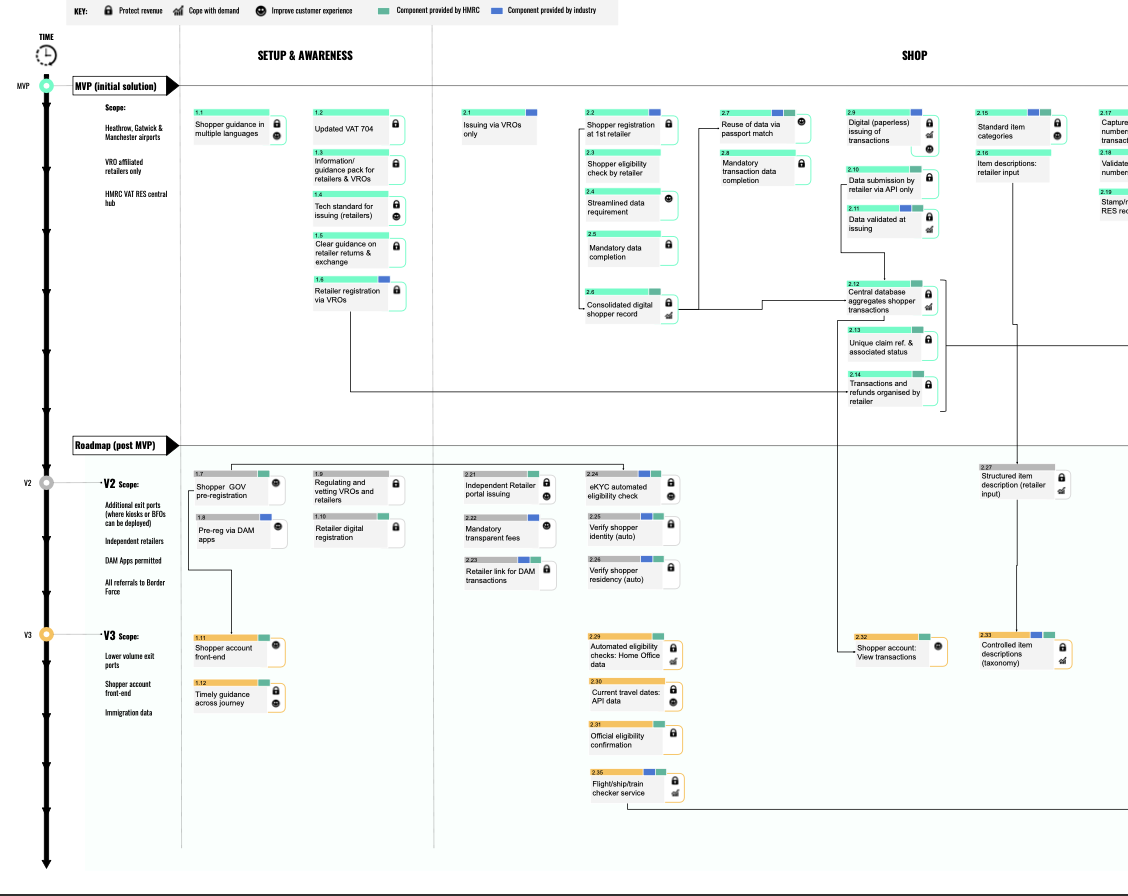

Proposed digital service roadmap

An initial roadmap, based on impact mapping workshops to illustrate the most critical MVP features of a digital service as well as post MVP enhancements.

Outcome: An artefact for supporting workshops & discussions on the initial scope of a digital VAT refund service.

Fraud & abuse risk map

VAT refund schemes are prone to abuse, so a key objective of a digital system is to close loopholes + design a more resiliant system. The research helped to identify & map the key types of abuse + determine how each type occurs.

Outcome: A checklist of abuse patterns to feed into the design process & test the robustness of any prosed solution against.

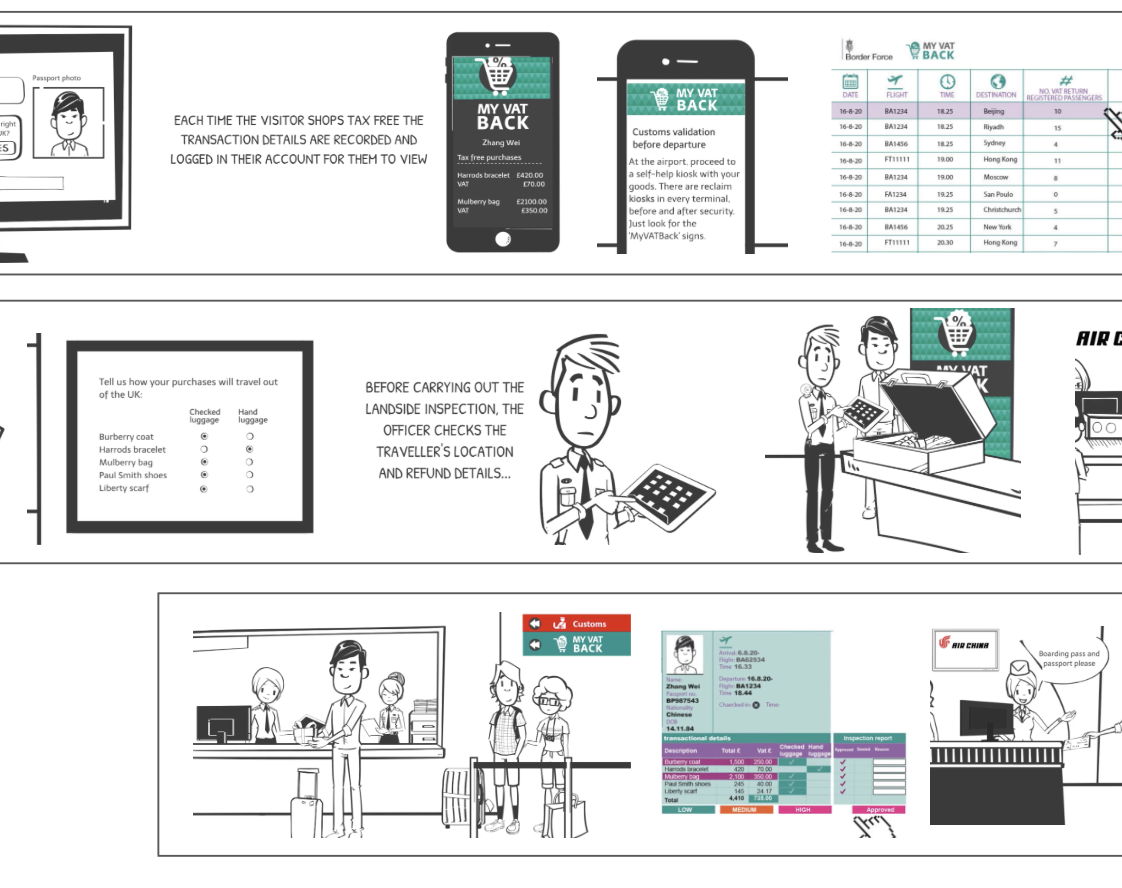

Proposed solution blueprint & animated demo video.

A blueprint was created for how the new digital system should work to enable efficient processing at POS, reduce resource demands on government & reduce abuse levels. An animated video was produced to illustrate the key elements & benefits of the approach.

Outcome: Workshops & demos to HMRC + cross government stakeholders. Delivery of the proposed blueprint to policy decision makers.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.